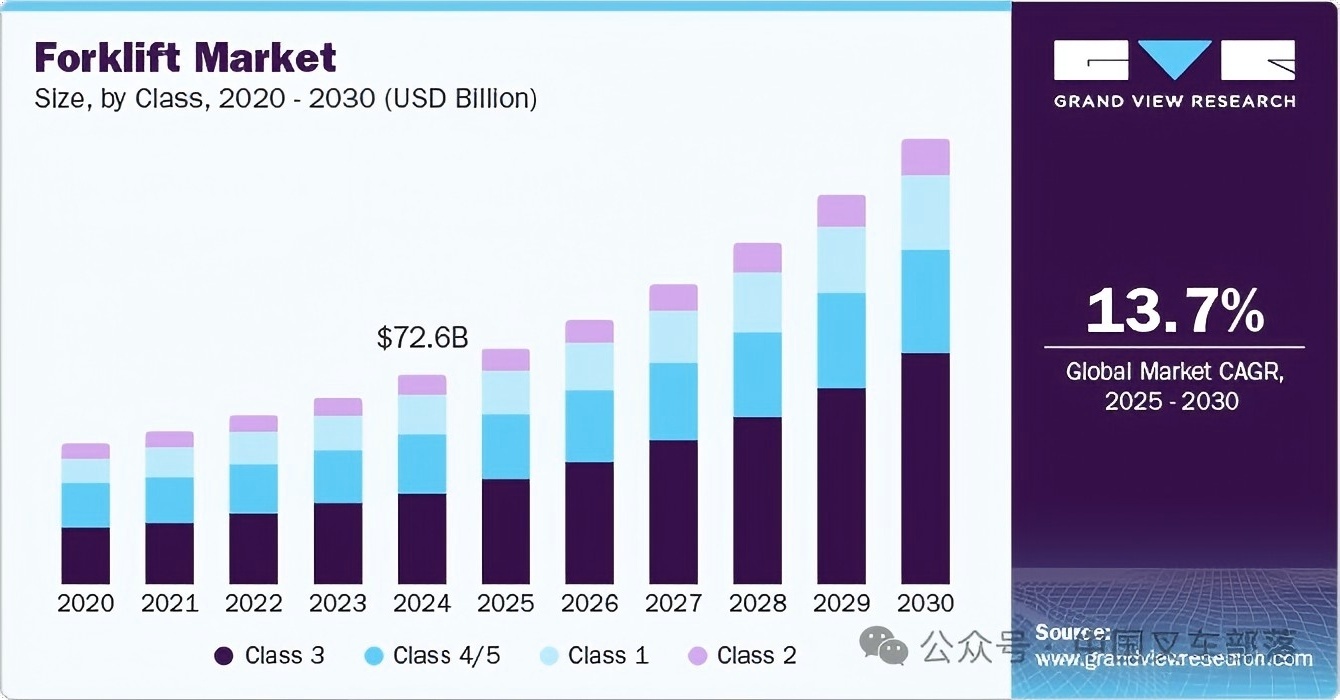

A report by Grand View Research states that Class III forklifts will hold the largest market share of 44.2% by 2024.

The e-commerce industry has experienced significant growth, driven by factors such as increasing disposable income, growing internet penetration, and enhanced shopping convenience. The surge in online shopping, coupled with unpredictable shipping and shopping patterns, and the direct-to-consumer model, has fueled substantial growth in retail sales.

This growth in retail sales has led to a significant shift in warehouse operations. Warehouses are now tasked with fulfilling large volumes of single-item orders. This shift demands greater efficiency from warehouse workers and forklifts in locating, selecting, and transporting goods within warehouse spaces.

According to the Forklift Report published by Grand View Research, Inc., this will propel the forklift market to reach $154.99 billion by 2030, growing at a compound annual growth rate (CAGR) of 13.7% from 2025 to 2030.

Manufacturers like Toyota Material Handling and Hyster-Yale Materials Handling, Inc. are heavily investing in R&D to produce technologically advanced autonomous forklifts. Hyster-Yale integrates forklifts with systems like Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS), providing employees with a complete, real-time view of automated forklift operations.

Furthermore, manufacturers are working to reduce autonomous forklifts' reliance on wires, magnets, and lasers. Autonomous forklifts deliver stable and consistent performance. These machines can lower costs associated with recruiting and onboarding new staff. They can reduce product damage and lessen the ergonomic impact on warehouse workers caused by physical labor and repetitive tasks.

Forklift suppliers continuously upgrade forklift technology to offer advanced features such as operator assistance, improved ergonomics, and onboard programming and diagnostics. For instance, in October 2022, forklift manufacturer and warehouse solutions provider Toyota Material Handling (TMH) launched an upgraded version of its three-wheel electric forklift, equipped with Toyota Assist's SEnS+ pedestrian detection technology to detect objects and people within its sensing range.

Other features include: enhanced energy efficiency, extending runtime per charge by 40%; an automatic power mode that detects inclines and automatically switches to a higher power mode to maintain speed; and lithium-ion batteries that minimize maintenance costs and reduce downtime, thereby boosting production efficiency. These improvements aim to enhance operator productivity while lowering the total cost of ownership over the forklift's lifespan.

Report Highlights Include:

In 2024, the Class III vehicle segment held the largest market share at 44.2%. The market is expected to gain momentum due to growing demand for material handling in small and medium-sized warehouses.

The following five segments are expected to register the fastest CAGR during the forecast period. Growth in this segment is driven by its versatility, compactness, and cost-effectiveness, making it a valuable asset for end-user industries seeking flexible and efficient material handling solutions.

The lithium-ion battery segment is expected to register the highest CAGR during the forecast period. These batteries are widely used in electric forklifts due to their longer lifespan, higher energy density, and faster charging times.

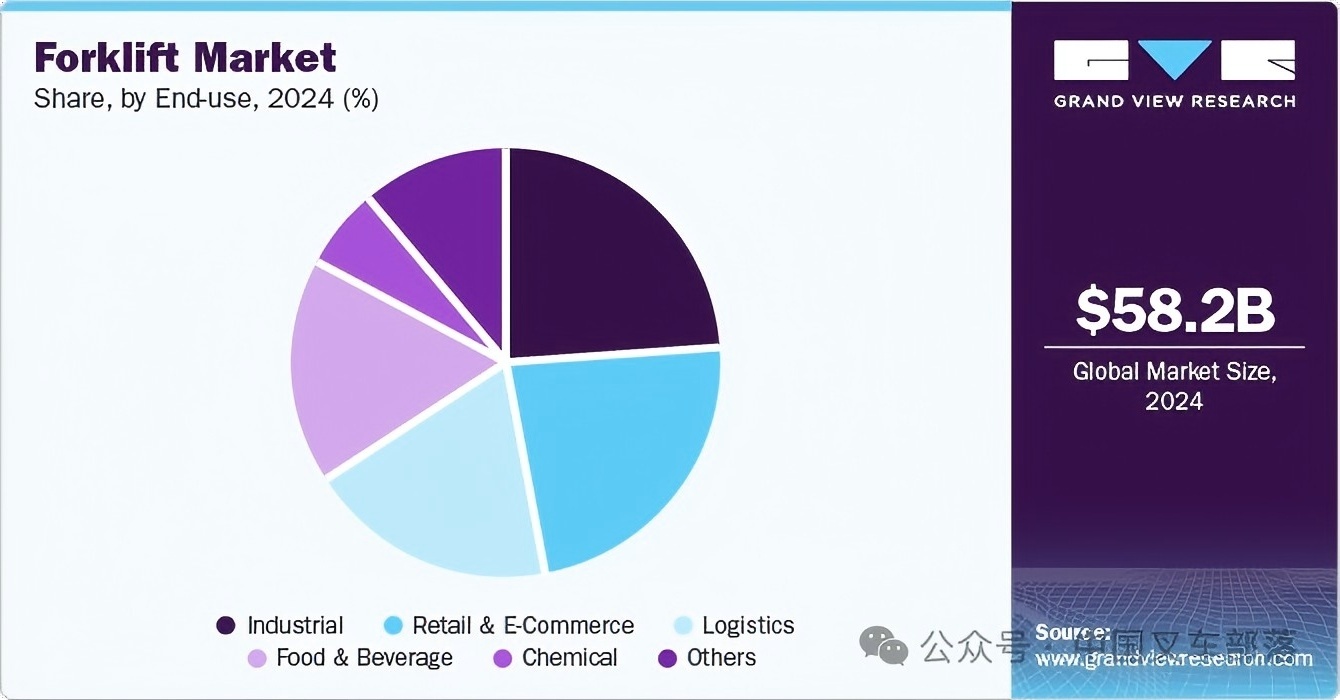

Retail & e-commerce are expected to register the highest growth rate during the forecast period. As businesses strive to optimize supply chain operations and boost productivity, they are investing in advanced warehousing facilities. Consequently, demand for efficient forklifts has surged significantly.

In 2024, the Asia Pacific forklift industry held 48.4% of the overall market share. Businesses in the region are integrating smart technologies like IoT sensors, telematics, and AI-driven fleet management systems into forklifts. These innovations enable real-time monitoring, predictive maintenance, and optimized route planning, helping end-user industries make informed decisions and save costs.

In August 2024, Crown Equipment Corporation opened a sales and service center in New Albany, Ohio. The new center is expected to provide customers in the region with material handling and warehousing solutions. It will also offer regional businesses essential equipment and services to enhance productivity and uptime, ensuring their material handling operations and supply chains remain efficient.

Forklift Market Size & Trends

The global forklift market size is estimated at USD 72.59 billion in 2024 and is expected to grow at a CAGR of 13.7% from 2025 to 2030. Global construction activity is growing significantly, particularly the expansion of road networks, improvements to airports and seaports, and modernization of railway systems. In the 2023-2024 budget, the government of Victoria, Australia, is expected to allocate approximately AUD 9.3 billion (around USD 6.18 billion) for infrastructure and energy investments. This budget presents substantial growth prospects for the state's construction sector.

Increasing focus on sustainability and growing environmental concerns are driving demand for eco-friendly alternatives and prompting a paradigm shift from gas or diesel-powered forklifts to electric ones. Governments in many countries are implementing various initiatives to achieve a net-zero economy. For example, in May 2023, FedDev Ontario announced a USD 3.6 million investment in forklift battery manufacturer Stromcore Energy Inc. to acquire advanced manufacturing equipment and launch new products to foster a green economy. The company plans to launch two energy-efficient products: the Electric Cart, a zero-emission electric forklift designed in collaboration with Amazon.com, Inc., and the Turbo Bank, a more efficient advanced AI charger. By assisting companies like Stromcore Energy Inc., the Ontario government is supporting green technology and manufacturing.

Efficient transport of goods and equipment is crucial for the construction and improvement of airports and seaports. Forklifts ensure goods are loaded and unloaded seamlessly onto aircraft and vessels, contributing to the timely delivery of materials and equipment for ongoing infrastructure projects. For instance, in June 2023, Port Authority of New South Wales launched a forty-year Master Sustainability Plan. The plan anticipates that population growth will triple existing container trade at Port Botany and increase the volume of motor vehicles and machinery transported through Port Kembla.

Furthermore, over the next four decades, demand for building materials will grow to meet housing and infrastructure needs, while the shift to renewable energy will drive trade in goods like components for offshore and onshore wind farms. Forklifts are ideally suited for navigating the busy environments of airports and seaports, enabling efficient organization and distribution of goods within these critical transportation hubs.

However, manufacturing forklifts requires raw materials like steel, lead, copper, and other products like rubber. These raw materials are sourced from various countries, and their supply is primarily influenced by commodity market and exchange rate fluctuations. Such volatility can negatively impact the supply chain and pose challenges for OEMs operating in the market.

Forklift Class Insights

In 2024, Class III forklifts held the largest market share at 44.2%. Class III forklifts include electric hand trucks. These are manually controlled forklifts steered via a tiller at the front of the vehicle. Hand trucks are typically controlled by a handle at the rear; the driver walks to the destination, steering using manual controls. These forklifts are commonly used for moving items requiring low-level lifting and can easily transfer goods across warehouse floors without placing products on high shelves or racks.

The Class I forklift market is expected to grow at a significant CAGR during the forecast period. Strong demand for electric forklifts from end-use sectors like retail stores, factories, food service, and chemical plants is expected to support market growth. These forklifts generally have fewer moving parts, reducing maintenance needs and overall costs. Ease of operation and quiet running make Class I forklifts suitable for various work environments, from warehouses to manufacturing plants, where noise levels and space constraints are key considerations.

Power Source Insights

In 2024, electric-powered forklifts held the largest share of the forklift industry. Electricity is an eco-friendly alternative to gasoline and diesel-powered forklifts. Growing environmental concerns and the depletion of fossil fuel resources are driving demand for sustainable, efficient, and durable forklifts that also ensure a healthier, zero-emission work environment for employees. Advancements in battery technology and an increased focus on ensuring healthier work environments for employees are expected to significantly drive growth in this segment during the forecast period.

Several suppliers are developing new electric forklift models to expand their material handling solution portfolios. For instance, in May 2023, industrial engine manufacturer AB Volvo Penta announced a collaboration with heavy equipment manufacturer FTMH Fantuzzi Team Material Handling Spa to develop electric forklifts. The partnership aims to develop an electric forklift with a lifting capacity of up to 52 tons.

Load Capacity Insights

In 2024, the 5-15 ton forklift segment dominated the market. 5-15 ton forklifts are commonly used for moving various materials, including pallets, steel, and bricks. They are considered efficient equipment for mechanized loading and short-distance transport. They can be used indoors and outdoors, fueled by natural gas, liquefied propane, or gasoline. These forklifts are typically rider-operated and are the most common type used for quickly and precisely lifting and positioning heavy loads. This versatility is expected to create lucrative growth opportunities for this segment.

The following five segments are expected to register the highest CAGR during the forecast period. These compact forklifts are versatile, enabling businesses to handle diverse loads efficiently. They can safely and easily transport products within limited footprints. Manufacturing, warehousing, material handling, logistics, and goods handling are application areas for these forklifts. Furthermore, when used for transporting hazardous goods within confined warehouse spaces, these forklifts enhance employee safety.

Battery Type Insights

In 2024, lead-acid batteries held the largest revenue share. Lead-acid batteries are considered a reliable power source due to their ability to deliver high power surges. Consequently, they are widely used in electric forklifts. Electric forklifts require high current output to perform heavy lifting and maneuvering tasks. Lead-acid batteries can provide the necessary power output, making them well-suited for these applications without significant voltage drops or power fluctuations.

The lithium-ion battery segment is expected to register the fastest CAGR during the forecast period. Growing environmental concerns are prompting businesses to seek eco-friendly solutions to reduce their carbon footprint. Lithium-ion batteries offer a cleaner alternative to traditional lead-acid batteries, which contain toxic chemicals like lead and sulfuric acid. By adopting lithium-ion technology in electric forklifts, suppliers are fulfilling their commitment to comply with increasingly stringent environmental regulations, indicating promising growth prospects for this segment.

End-Use Insights

In 2024, the industrial segment dominated the market. Forklifts are extensively used for material handling and warehousing tasks in industrial settings. Within manufacturing plants, forklifts play a crucial role in transporting raw materials, intermediate products, and finished goods along production lines. Their ability to move heavy loads and navigate confined spaces helps ensure smooth material flow, reducing production bottlenecks and enhancing operational efficiency.

The retail & e-commerce segment has undergone significant transformation in recent years, fueled by changing consumer preferences and the rise of online shopping. Over the past few years, the retail and e-commerce industry has experienced remarkable evolution, driven by shifts in consumer preferences and growing demand for online shopping. Within this dynamic landscape, forklifts have become indispensable, offering tailored applications to support efficient material handling and logistics operations. Forklifts play a vital role in streamlining warehouse operations, ensuring seamless movement of goods from order receipt through storage to order fulfillment. Their compact design and precise control allow for agile maneuvering in tight spaces, optimizing space utilization and accelerating inventory management.

Regional Insights

In 2024, the Asia Pacific forklift industry held 48.4% of the overall market share. Asia Pacific is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Group, who are driving technological innovation and enhancing industry competitiveness. As major companies continue to develop advanced electric forklift models with superior performance and features, end-users are upgrading their forklift fleets to maintain competitiveness and efficiency. As the market evolves, collaboration among governments, manufacturers, and businesses is expected to play a crucial role in driving the further development and widespread adoption of forklifts across Asia.

In 2024, China held a substantial share of the forklift market. Driven by industrial expansion, government policies promoting smart manufacturing, and a thriving e-commerce sector, China's forklift market is experiencing rapid growth. China's focus on sustainability and carbon neutrality is accelerating the shift from internal combustion engine (ICE) forklifts to electric and hydrogen-powered models.

In 2024, Japan held a considerable share of the forklift market. In Japan, the forklift market is evolving amidst an aging workforce and growing demand for automation in logistics and manufacturing. Businesses are investing in robotic and AI-powered forklifts to enhance operational efficiency and reduce reliance on manual labor. Sustainability goals are also shaping the industry, with electric forklifts gaining increasing favor over traditional fuel-powered ones.

Europe Forklift Market Trends

The European forklift industry was identified as a lucrative region in 2024. Evolving due to regulatory changes, technological advancements, and growing e-commerce activity, the European market is undergoing transformation. The sustainability push is accelerating the shift from diesel and gas-powered forklifts to electric and hydrogen-powered models across various industries. Automation and robotics are gaining favor, with increasing adoption of autonomous forklifts to improve logistics efficiency and reduce labor dependency. The expansion of smart warehouses and digital supply chains is also driving demand for IoT-integrated material handling solutions.

The German forklift market is influenced by its strong industrial base, stringent environmental regulations, and advancements in automation technology. As a leader in manufacturing and logistics, Germany is experiencing growing demand for electric forklifts, driven by sustainability initiatives and EU carbon reduction targets.

North America Forklift Market Trends

In 2024, the North America forklift industry held a considerable market share. Driven by increasing automation, e-commerce expansion, and growing demand for sustainable material handling solutions, the North American market is advancing. With the rapid development of warehouses and distribution centers, businesses are investing in electric and autonomous forklifts to enhance operational efficiency and reduce carbon emissions. Strict environmental regulations and government incentives are also accelerating the transition from internal combustion engine (ICE) forklifts to battery-powered and hydrogen fuel cell alternatives.

U.S. Forklift Market Trends

In 2024, the U.S. forklift industry held a dominant position. Undergoing significant transformation driven by automation, sustainability initiatives, and expansion in industrial and retail sectors, the U.S. market is evolving rapidly. The e-commerce boom is intensifying the need for efficient warehouse management, thereby driving the adoption of electric and autonomous forklifts.

Key Forklift Company Insights

Key players in the market include Toyota Motor Corporation (Toyota Material Handling), KION GROUP AG, Jungheinrich AG, Crown Equipment Corporation, and Mitsubishi Logisnext Co., Ltd.

Mitsubishi Logisnext Co., Ltd. is dedicated to developing, designing, and marketing engine and electric forklifts, AGVs, electric vehicles, automated warehouses, monorails, transport robots, and other logistics equipment. The company has a strong market presence in North America, Europe, Asia, and Oceania, as well as China. For the company, Asia represents the region with the most significant potential for future growth.

Jungheinrich AG is an intralogistics solutions provider offering a wide portfolio including material handling equipment, digital solutions, automation systems, and related services, including rental and after-sales support. The company provides customers with one-stop, customized solutions to expand their intralogistics services. It has developed an automated intralogistics workflow covering various automated warehouse equipment, mobile robots, and software.

Leading Forklift Companies:

The following are leading companies in the forklift market. Collectively, these companies hold the largest market share and lead industry trends.

Anhui Heli Co., Ltd.

Clark Material Handling Company (Clark Equipment Company)

Crown Equipment Corporation

Doosan Corporation

Hangcha Group

Hyster-Yale Materials Handling, Inc. (Hyster-Yale Group, Inc.)

Jungheinrich AG

KION GROUP AG

Komatsu Ltd.

Mitsubishi Logisnext Co., Ltd.

Toyota Industries Corporation (Toyota Material Handling)

Source: China Forklift Tribe May 15, 2025

Copyright © 2026 Fujian Skystone Intelligent Equipment Co., Ltd. All Rights Reserved.

Network Supported

Network Supported